Is Understanding Costing You Money?

Is Understanding Costing You Money?

People tend to fear what they don’t understand. Homeowners understand fixed rate mortgages and remember the horror stories of people who lost their homes because they could no longer afford them when their adjustable rate mortgages went up.

Interest rates on fixed-rate mortgages have be so low for enough years, that borrowers haven’t even given much consideration to an adjustable rate mortgage. Changes in the way adjustable rate mortgages are now made make them much safer for borrowers who understand not only how they work but know they’ll only be in the home for a limited period of time.

Adjustable rate mortgages can go up or down according to an index that the lender has no control. The amount that can be adjusted is limited by caps for each period and for the life of the loan. While there are different periods for ARMs, the most popular lock the first period for five to seven years and then, can adjust annually after that.

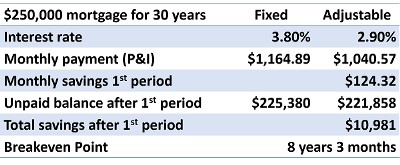

One quick and easy way to determine whether an adjustable may be a viable alternative to a fixed would be to determine the maximum payment adjustments possible to find out when the savings from the early years are exhausted which would be the breakeven point. If the borrower is certain they’ll move prior to that date, the ARM will definitely provide a lower cost of housing.

The break-even point for a $250,000 mortgage would be 8 years 3 months comparing a 2.9% 5/1 adjustable-rate with 1 and 5 caps to a 3.8% fixed-rate mortgage. In the initial five-year period, the payments on the ARM would be $124.32 lower and the unpaid balance would be $3,522 less than the fixed-rate to make a total savings of $10,981.

One of the big banks has a voluntary program available that transfers $100 each month from your checking account to your savings account. In five years, the account owner would have over $5,000 because of a type of forced savings.

One of the big banks has a voluntary program available that transfers $100 each month from your checking account to your savings account. In five years, the account owner would have over $5,000 because of a type of forced savings.  An Automated Valuation Model, AVM, is a computer approach that looks at public records to make a determination based on square footage, comparable sales and other elements. It is as easy as putting your address in a blank but unfortunately, AVM results may only be accurate about 20% of the time.

An Automated Valuation Model, AVM, is a computer approach that looks at public records to make a determination based on square footage, comparable sales and other elements. It is as easy as putting your address in a blank but unfortunately, AVM results may only be accurate about 20% of the time. The principle to pay yourself first has been referred to as the Golden Rule of Personal Finance.

The principle to pay yourself first has been referred to as the Golden Rule of Personal Finance.