Financing Today

We're constantly bombarded by lenders to refinance our mortgage under a variety of programs. The volume of offers can almost make you numb to the rational consideration.

We're constantly bombarded by lenders to refinance our mortgage under a variety of programs. The volume of offers can almost make you numb to the rational consideration.

There are common rules of thumbs that homeowners and agents use such as not refinancing more often than every two years or there must be at least 2% savings from your previous mortgage rate may not always be accurate.

The reality is that if you can refinance for a lower rate and you'll be in the home long enough to recapture the cost of refinancing, it should be considered. The costs of previous refinancing that haven't been recaptured by monthly savings may need to be added to the costs of the new refinance.

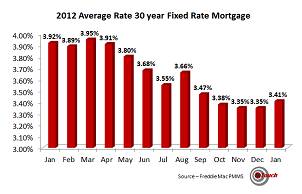

Take a look at the chart that shows the average rates according to Freddie Mac for 2012. They are lower today than they were in January of 2012 and for the ten years before that.

Refinancing may save you a substantial amount of money, especially if you're going to be in your home for a long time. It is definitely worth investigating. To get a quick idea of what your savings could be, use this refinancing calculator.

If you have any additional questions about financing and rates here in the Bethany Beach or Fenwick Island area please feel free to contact us, we will be happy to assist you in your search for the perfect beach home.

REMAX By The Sea

Frank@TheSerios.com

"Like" us on Facebook